'Tis the season to go shopping – in our pajamas

Love it or loathe it, Black Friday is here.

For decades, it's been the day (and lately, even the couple of weeks) for cashing in on deals that can help make the most of a Christmas budget. Black Friday got its start in the U.S., attaching itself to their Thanksgiving weekend, but over the years, it's crept into Canada, with stacks of flyers trumpeting discounts that would make our neighbours to the south proud.

How can you get the biggest bang for your buck on this annual consumer tradition? We asked JR Shaw School of Business Finance instructor Tannya McBride (Finance '07) for tips on snagging a steal, staying on budget and shopping in your pajamas.

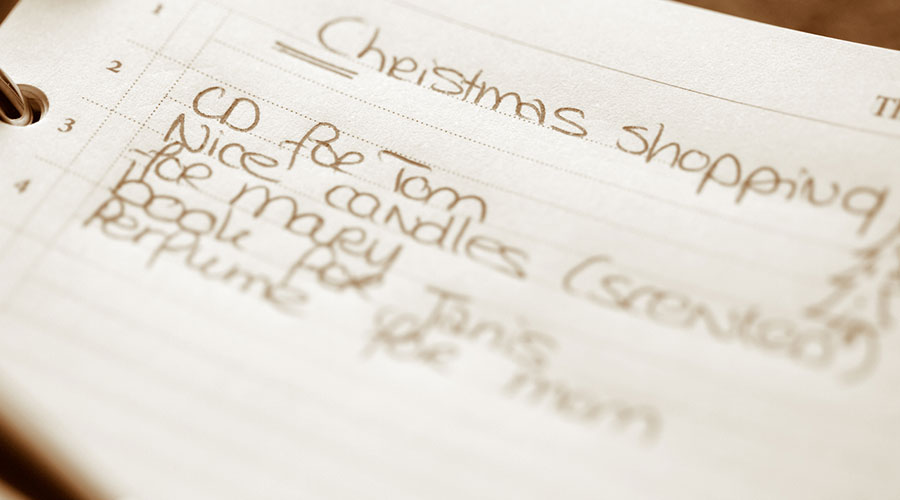

1. Make a list

When you go to the mall or even if you're shopping online, all you see is “sale, sale, sale, and then you end up buying things you don’t need,” says McBride. A list keeps you focused.

When you go to the mall or even if you're shopping online, all you see is “sale, sale, sale, and then you end up buying things you don’t need,” says McBride. A list keeps you focused.

2. Set a budget

“Mistake Number 1 is not having a budget,” says McBride.

Mistake Number 2 not sticking to it. If you’ve only allotted $50 for your sister but that perfect sweater is $75, “Let it go, and find something in your price range.”

“Mistake Number 1 is not having a budget.”

Monitor your money as you shop. How much have you spent? How quickly?

“It’s an eye-opening experience. Nobody really takes the time to sit down and add it up.”

To make that job easier, McBride uses mint.com, a web-based and mobile money-tracking app that connects directly to your accounts. Let technology help keep your finances front of mind, but prevent them from weighing too heavily upon it.

3. Protect yourself online

If you do buy online, “Be careful,” says McBride.

“Especially around Christmas – and Black Friday and Cyber Monday – a lot of fake websites pop up.”

Know your retailer, check the URL for anomalies. Protect yourself with a free PayPal account, she adds, which prevents sharing credit card info directly with sellers.

4. Pay it off quickly

Sure, you got some great deals, but don't let the costs go unchecked for long.

Say you use a department store card with a 29% rate of compounding interest and spend $1,000. If, by the following Christmas, you “don’t manage to pay down the debt,” says McBride, “you’re paying $1,300 or more.”

If you're not able to pay it off right away, that's OK. Transfer the debt to a lower-interest line of credit. Set up a monthly payment plan. Or, put your income tax return to good use come spring.

“Most people think of it as a bonus, but [paying down] debt should be a priority,” says McBride – especially if, next Black Friday, you see deals too good to refuse.

Banner image by gpointstudio/istockphoto.com